If you are an Applicable Large Employer (ALE), you may still be catching your breath from 2015 Patient Protection and Affordable Care Act (ACA) reporting. However, in a couple of weeks the process starts all over again as you prepare for the 2016 reporting cycle. As with all new requirements, the first filing cycle had some bumps as there was little guidance for some of the questions and issues that arose. In preparation for 2017, let’s take a look at the “C” forms and discuss areas of the forms that may have been confusing.

If you are an Applicable Large Employer (ALE), you may still be catching your breath from 2015 Patient Protection and Affordable Care Act (ACA) reporting. However, in a couple of weeks the process starts all over again as you prepare for the 2016 reporting cycle. As with all new requirements, the first filing cycle had some bumps as there was little guidance for some of the questions and issues that arose. In preparation for 2017, let’s take a look at the “C” forms and discuss areas of the forms that may have been confusing.

To refresh, the C forms are used by ALEs to report information about their offers of health coverage as required under Section 6056. For self-insured ALEs, the C forms are also used to report coverage information for individuals enrolled in the ALE’s health plan as required under Section 6055. All ALEs are required to file 1094/1095-C forms regardless of what kind of coverage, if any, they offer. ALEs with self-insured plans or fully-insured plans, as well as, ALEs that offer no plan are subject to Section 6056 reporting. See my blog “Making Sense of Form 1095 Minimum Essential Coverage Reporting.”

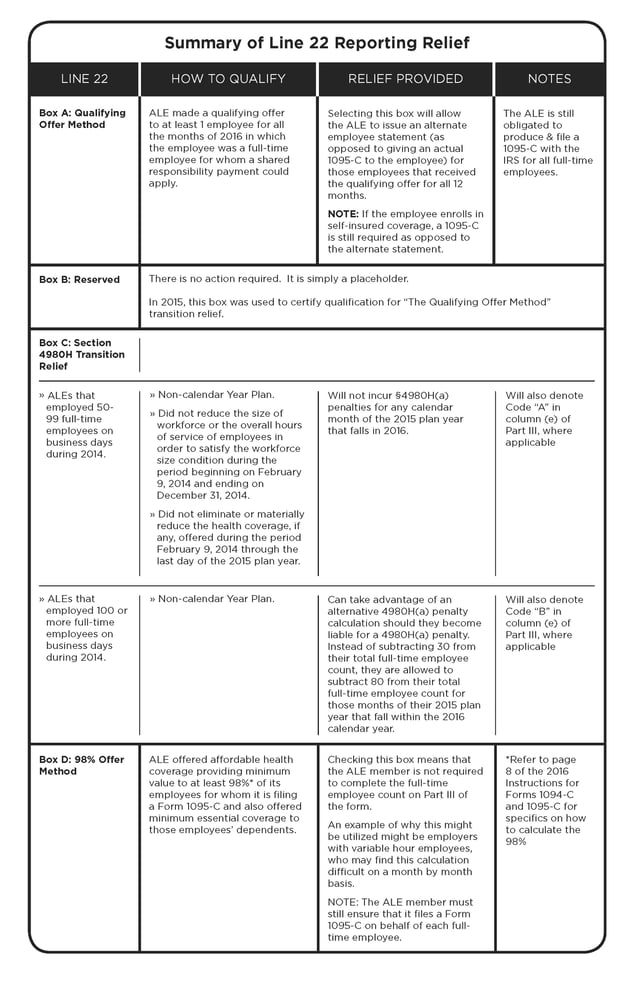

The 1094-C is the transmittal form that goes along with all of your 1095-C forms when you submit them to the IRS. It has four parts and in general, the 1094-C is pretty straightforward. However, Line 22, located in Part II of the form, deserves some discussion. Line 22 is used to indicate when an ALE is eligible for one or more types of reporting relief. A response is not mandatory and is only necessary if an ALE wishes to take advantage of one of the relief options.

It probably seems obvious, and this will sound a bit like a tongue twister, but it may be helpful to review the relief that is provided prior to going to the effort of determining whether you meet the requirements of the relief. Said differently, if the relief for meeting certain requirements isn’t of value to you, there is little value in taking the time to determine if you qualify for the relief. The table below provides a summary of the relief options available for selection on Line 22.

The 1095-C is employee/participant specific and one is generated for all full-time employees. In addition, if it is a self-insured plan, a 1095-C is also generated for any non-full-time individual who enrolled in the plan.

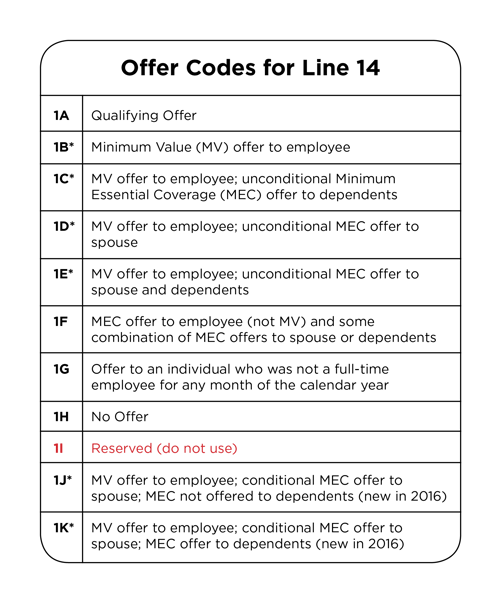

An area of confusion on the 1095-C is Part II. This area requires that you understand the different codes used to report the various “offer” situations that might exist. Deciphering these different situations can be somewhat like playing a game of Twister as multiple codes may be applicable

Line 14 – Offer of Coverage Code

This line captures the code that reflects the offer an ALE made to the employee on a month-by-month basis. For some employees, this may be straightforward. For example, the employee may have been employed for the entire year and may have received an offer at the beginning of the year, which covered all 12 months and no changes occurred with regard to that employee’s offer throughout the year. Therefore, one code can be used for all 12 months. However, when an employee is hired or terminated, the code will not be the same for the entire year. Throw in situations where employees go from part-time to full-time, or perhaps you have a rehire situation, and it can become quite complicated.

In 2016, there were 11 different offer codes. However, one of these codes (1I) is not to be used, so essentially there are 10 options available.

Line 14 is mandatory and should always have a code entered.

*If used on Line 14, then line 15 must be completed.

Line 15 – Employee Required Contribution

This line captures the amount the employee would be required to contribute for the lowest cost minimum value coverage that was offered by the ALE. Note: This is not necessarily what the employee enrolled in. Line 15 is used by the IRS to determine if the minimum value coverage that was offered meets the affordability requirement. NOTE: Line 15 is only to be completed when the code on Line 14 is 1B, C, D, E, J or K. When any of the other codes are used on Line 14, line 15 is to be left blank because the IRS does not need to ascertain affordability.

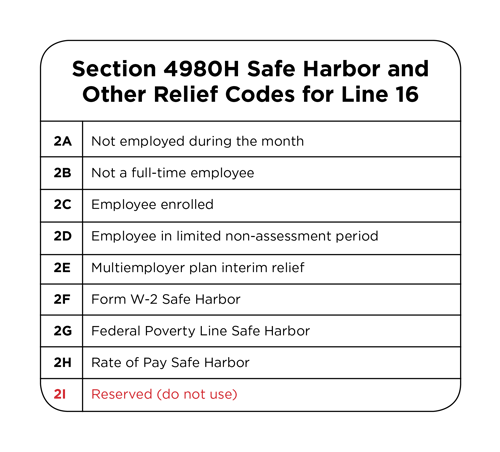

Line 16 – Section 4980H Safe Harbor and Other Relief Codes

This line is used to provide a reason why an ALE member should not be liable for a 4980H(b) penalty. Line 16 provides additional information to substantiate why a penalty should not apply to that particular employee’s offer, or lack of an offer. Line 16 is not mandatory, so depending on the code used on Line 14, you may, or may not, need to provide a code on this line. Examples where you may wish to provide a code include:

- Codes 2A, B, D, or E could be used to explain why an offer was not required for an employee. For example, Code 2A is used for months in which a terminated employee has COBRA.

- Codes 2F, G, or H might be used in situations where affordability of the offer is questionable based on the figure on line 15.

- Code 2C is applicable if the employee enrolled in the coverage for each day of the month and was full-time for at least one month during the year.

Those are the areas of the 1094-C and 1095-C that seemed to be the most confusing for many ALEs. Although the information presented here by no means extinguishes this confusion, our intent was to help explain the purpose of the more confusing parts and how certain responses can prove beneficial so that determining those responses is less frustrating.

By Vicki Randall, Originally Published By United Benefit Advisors